The U.S. Department of Labor in August significantly increased its penalties for retirement plan sponsors who get caught making compliance errors before they correct them on their own. What previously might have only been a fine of a few hundred dollars through the DOL’s Voluntary Fiduciary Correction Program can instead result in penalties high enough to force a small business to shut its doors.

The DOL says the penalties have been adjusted for inflation, the first time they have done so since 2003. Moving forward, these penalties will be adjusted for inflation annually beginning this month.

The DOL says the penalties have been adjusted for inflation, the first time they have done so since 2003. Moving forward, these penalties will be adjusted for inflation annually beginning this month.

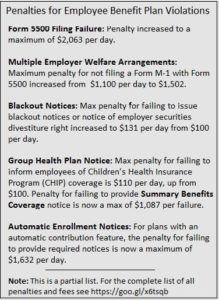

One of the steepest penalty increases surrounds Form 5500. Plan sponsors who do not file this annual report required for retirement plans now face a daily fine of up to $2,063. Previously, the fine was up to $1,100 per day.

Many of these penalties can stem from unknowing omissions, not just overtly intentional actions. And that may be the result of having an absentee plan advisor. With small businesses facing the potential of steeper penalties, it’s more important than ever that they are fully aware of the work their plan advisor is doing for them.

A majority of small market retirement plans (with less than $50 million in assets) have advisory fees built into the expense ratios of the investments they offer to their participants. These fees are known as “12b-1 fees.” However, far too few plan sponsors have ever met the advisor receiving those fees.

If you haven’t seen your plan advisor in a year, you need to. An annual meeting with a retirement plan advisor can help ensure that the plan is passing the non-discrimination tests important to maintain its tax qualified status and that the plan sponsors are managing their fiduciary obligations.

Some of these penalties are so high, they can push a small company out of business, a huge consequence for a rule they may not know exists.

I’m a retirement consultant at Retirement Benefits Group in San Diego. Last year, I discovered that one of our new clients had never met their previous advisor to review the plan’s compliance. This failure to meet with the client resulted in a failure to file the company’s past two Form 5500s, which could have resulted in a huge penalty of up to $1.5 million over the two years. Instead, our client only paid an $800 voluntary correction fee.

If you hire a new retirement plan advisor for your company’s 401(k) plan, ask that person to conduct a full review of the plan. A thorough review should include:

- Benchmarking (fees, vendors and plan design).

- Completing the DOL audit checklist.

- An analysis of how the fees are paid.

- A thorough review of the investment options available to participants.

Several failures (easily identified on a 5500 filing) can attract the attention of the DOL. Examples include a gap in the 5500 filing, late contributions, no fidelity bond and others.

Work with a consultant who will help maintain a fiduciary file that will ensure you are well prepared for potential DOL audit.