This week, I’ve been exploring the four key reasons why employers do not prioritize benefits education even though the majority of employers are very eager to increase employee satisfaction with their benefits package. These four reasons are:

- Short staffed HR departments that are forced to triage and focus on only the most urgent issues as opposed to the longer term strategic planning that education requires.

- Concerns about legal liability associated with crossing the line into providing employees with “advice” about benefits.

- Cynicism that education doesn’t really work because retirement plan providers have struggled to increase retirement plan deferral rates despite offering online and live educational support. (today’s topic).

- Uncertainty about the best way to actually help employees make benefits decisions.

The struggle to educate about retirement benefits

Today, I want to address the common cynicism expressed by some employers that benefits education really doesn’t work. This view has been brought about because retirement plan providers have struggled to increase retirement plan deferral rates despite offering online and live educational support.

When I think back to my years working for a large insurance company marketing 403b plans, I cringe at the memory of my “lunch and learn” seminars where I would spend an hour talking about the fund lineup and asset allocation, the tax benefits of salary deferral, and how much employees needed to be saving. This is the typical retirement planning seminar, right?

Well, what I wasn’t communicating was how to come up with the money I was telling them they should be saving. As a general rule of thumb, most financial experts recommend employees should save at least 10 percent of their pay throughout their career, but based on the Profit Sharing/401k Council of America (PSCA) 52nd Annual Survey of Profit Sharing and 401(k) Plans, the average deferral rate is only 5.5 percent. So if the traditional retirement education isn’t working, what will?

Since 1 in 4 workers are living paycheck to paycheck, what IS needed for these employees is basic money management skills and ongoing general financial education to assist them in finding the way to save for retirement.

A correlation between education and deferral rates

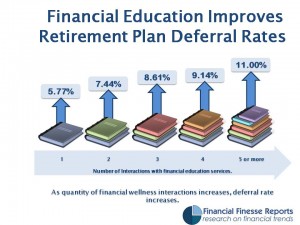

A recent case study with Aetna showed a direct correlation between ongoing financial education and increased deferral rates, with their average deferral rate of 5.77 percent increasing up to 11 percent for those employees who took advantage of attending five (5) or more workshops and one-on-one counseling sessions that focused on holistic financial education, not just retirement education.

A recent case study with Aetna showed a direct correlation between ongoing financial education and increased deferral rates, with their average deferral rate of 5.77 percent increasing up to 11 percent for those employees who took advantage of attending five (5) or more workshops and one-on-one counseling sessions that focused on holistic financial education, not just retirement education.

I actually conducted quite a few of the one-on-one sessions, and many of the conversations focused on budgeting, cash flow, and debt management. Once the employees were able to get their short-term expenses and spending under control, it made the topic of saving for retirement much more realistic and not just a lofty goal.

So, in putting together a plan to communicate your retirement benefits, don’t overlook the fact that general financial education should be a core focus.

This was originally published on the Financial Finesse blog for Workplace Financial Planning and Education.