Right now, it seems like everything I read is focusing on artificial intelligence (AI).

It’s not surprising really. AI is an amazing new tool, capable of doing some exceptional things now.

And yet, we must all remember that AI, and the information we take from using it, is always (and ultimately) dependent on the source of data the technology uses for its learning.

I say all this because it’s my belief we need to remember this when it comes to the power of something just as exciting – Employee Intelligence, or EI.

If AI can be described as pulling in a variety of information to summarize and provide users with better (or at least, different and unique), answers to questions, my view is that EI can to be used to support AI and other data analysis efforts and make even better decisions.

Why collect Employee Intelligence for decision-making?

Let’s start at the beginning. Employees are all the time having day-to-day interactions with customers, vendors, and community members. The information in your employees’ minds can provide leaders with valuable, additional, and unique data that will help leaders make better decisions.

But same rules that apply to AI also apply to EI. This is that data needs to be updated, aggregated, and analyzed so that the receiver of the data can use it to improve learning and decision-making.

The latest Leadership Pulse data, taken from a project I have been running since 2003, provides insight into how useful employee data can be to leaders who are learning how to obtain and analyze EI.

It’s my view that the same type of intellectual curiosity that sets someone out to learn about AI should make that same individual curious about using EI.

It may seem obvious that leaders learn from the knowledge of their employees, but the extent to which employee insights are used for decision making is rarer than you might think.

Organization growth questions

So, how do leaders learn from employees?

It may be through important (but limited), one-on-one conversations, engaging in listening sessions or walking around. Or, it maybe through focus groups and surveys.

Many of these methods are not done frequently enough to gather ongoing trended data, and the questions used are normally too narrow to be a source of real discovery of unknown issues.

Thus, the richness of employee data is often not part of leaders’ decision-making.

I recently wrote a chapter about what we learned in 20 years (2003 – 2023), of conducting the Leadership Pulse.

This is a project I started when I was on the faculty at the University of Michigan. We conducted quarterly surveys with a sample of leaders throughout the world.

Our goal was to learn from using a real-time survey tool that allows us to not only collect data, but also provide the leaders with access to their own data.

Giving leaders their own personal responses and benchmarking encouraged them to continue participating.

When writing the 20-year report I rediscovered the first set of questions that I used, and I decided to run them again in 2023. My goal when I started the work in 2003 was to ask leaders what they expect in terms of future business growth.

Given the high amount of change we were experiencing in 2023, and the additional change we know will occur this year, I thought it may be a good time to bring back the Growth Projection Pulse™ questions.

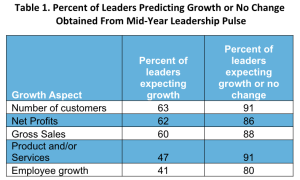

The table below is a summary of the results showing the percent of people from the sample (about three hundred leaders) who expected growth or no change in the various growth categories studied.

When I received the results of the survey, I remember thinking that people were more positive than I expected they would be.

At this time, the news was dominated by rising inflation, interest rates, the price of gas, and there was not a sense that growth was on the horizon. For example, in a report published June 1, 2023 by the Mercatus Center at George Mason University, they note that: “The Federal Reserve Bank of Philadelphia survey of 37 forecasters in February indicated negative real GDP growth in this year’s (2023) third quarter.” Earlier, in a January Wall Street Journal survey of seventy-nine economists, was the prediction of negative GDP growth in 2023’s second quarter and third quarter growth at almost zero. In a more recent survey, in April, that panel moved the recession’s start to the third quarter. In short, to all intents and purposes, the prospects for the year ahead were biased toward slower growth, crossing the line to become recessionary.

But as I looked at the data from the mid-2023 survey, which showed 80% or more growth or stable expectations, and then reviewed what happened at the end of 2023, I realized the people responding were pretty accurate at predicting the future.

GDP went up 4.9% in the third quarter of 2023 and an estimated 2.6% in the fourth quarter. Employment-related metrics such as unemployment and participation rates showed minor change.

We found that the participants in the Leadership Pulse who are leaders from various parts of the world ‘were’ able to predict what will happen in the latter part of 2023.

Employee Intelligence to Drive Your Organization’s Performance

The question then is what other kinds of information employees can share that can help leaders better prepare for the future and make better decisions.

Leaders can use employee intelligence to turn around their organizations, solve specific problems, or build for growth.

One story in particular comes to mind on this topic.

I was walking around a manufacturing plant with the CEO of the organization.

He was proud of the high-quality interactions he had with his employees, and as we toured the site, he would point to one person in each department. For each employee, he had a story about the last time he talked to that person, what a great relationship they had, and how much information that individual shared with him.

When we were almost done with the tour, he turned to me and stopped. Then he said something like “you know, I didn’t realize until now how many people I don’t hear from.”

That is when the big light bulb went on for him.

He did not have employee intelligence; he had selected conversation insights. Those are two different things.

He then moved on to developing a strategy for using employee intelligence to solve one of his problems at the plant that focused on quality.

We worked together on a three-month experiment. In month one we did a survey of all employees in the plant. It was specific and short.

We started the survey out by writing up a scenario, talking about a recent quality challenge that everyone knew about.

Then we asked employees to think about the topic overall and rate on a 0-to-100-point scale where the plant was today.

Next, we asked them to explain the answer, and lastly, we asked each individual person to report one action he/she could personally take in the next 30 days (time is important) to improve quality.

After gathering the employee intelligence on this focused topic, we asked the leader to do a ‘road show’ discussing the topic, results from the survey, and ideas that came out of the survey.

This was phase two. After gathering employee intelligence, he shared the results.

Phase three focused on developing action steps based on what employees suggested, and in a brief period there were significant improvements in quality.

Introducing the DDAR Model

The model I use to describe the overall process I used with this organization and the CEO in question is called the DDAR model™, which stands for Data, Dialogue, Action and Results (as seen in the graphic below).

Step one involves collecting data or employee intelligence (EI). Based on numerous projects using this process, I strongly suggest leaders do NOT act on the data until they engage in dialogue with their employees.

This is because data plus dialogue leads to not only clarification of the data but motivation of the pool of people to help share data or intelligence in the future.

Then, only after combining data and dialogue, leaders should act.

Then once they have results from their action-taking, they should communicate results, and cycle back to obtain more data for clarification and continuation of the work.

The reason for ongoing data collection is that trend data is much more powerful than point-in-time data.

This year add EI to your AI efforts

In the project described above, because we wanted to have an in-depth understanding of what employees were communicating, we manually coded the comment data.

Today, leaders and researchers have the luxury of using multiple types of qualitative data analysis programs and artificial intelligence to sort through data and better understand results.

Employee intelligence (EI) is high quality data that every organization has but that they do not tap into frequently enough, or with adequate focus to make better decisions.

In your quest to use artificial intelligence, I strongly suggest you also consider making an equivalent effort to tap into your own strategic EI assets.

AI analysis for the leadership pulse growth comment data

As a last part to this article, I decided to use AI to analyze the comment data.

We asked individuals who responded to tell us in an open-ended comment question why they answered the way they did.

Then I asked ChatGPT to analyze those responses by indicating the differences in comments for people who responded to the quantitative question as no growth or high growth.

Below are the results – all that came directly from ChatGPT:

Sentiment analysis summary.

No Growth: The sentiment distribution shows an even spread between neutral, positive, and negative sentiments, indicating a mix of caution, slight optimism, and concerns among respondents.

High Growth: Comments associated with high growth expectations had a larger proportion of neutral sentiments but also a significant amount of positive sentiment, suggesting cautious optimism with fewer negative sentiments compared to the no growth comments.

Theme distribution summary:

No Growth: Market conditions were a common theme, suggesting concerns about external economic factors influencing growth perceptions. Internal dynamics and customer engagement were mentioned but to a lesser extent, indicating some concerns about internal capabilities and customer relations. The presence of other themes suggests a diversity in concerns or issues not directly related to the predefined themes, possibly indicating specific operational or industry-specific challenges.

High Growth: Market conditions remained a significant theme, but the context might be more about navigating or leveraging these conditions for growth. Internal dynamics and customer engagement were also important, but seemed to be associated more positively, reflecting confidence in internal capabilities and customer strategies to support growth. Product development was more pronounced in high growth comments, indicating optimism about innovation and product strategies driving growth.

Additional summary results from ChatGPT

The analysis of the comments associated with scores of no growth and high growth highlights several distinguishing factors, but one key differentiator stands out: the presence and focus on product development as a theme among high growth expectations comments.

Key Differentiator: Focus on product development

High Growth: Comments in this category more frequently mention aspects related to product development, indicating a strong belief in innovation, new product lines, improvements, and expansions as central drivers of growth. This suggests that respondents with high growth expectations are optimistic about the organization’s capabilities to innovate and adapt, viewing these as critical levers for achieving significant growth.

No Growth: While concerns about market conditions and internal dynamics are prevalent in both groups, the specific focus on product development is less pronounced in comments with no growth expectations. This group might be more concerned with external economic factors and internal challenges, overlooking or undervaluing the potential impact of product innovation and development on growth.

Implications

This emphasis on product development among high growth respondents underscores the importance of innovation and adapting product strategies to meet market needs and opportunities as key optimism drivers.

It suggests that confidence in an organization’s product strategy, R&D capabilities, and ability to launch successful new products or improve existing ones is a critical factor distinguishing those who expect high growth from those who do not.

Organizations can leverage this insight by focusing on communicating and highlighting their commitment to product innovation and development as part of their growth strategy.

For stakeholders and potential investors, highlighting successful case studies of product innovation or upcoming product launches could reinforce growth expectations. Internally, it emphasizes the need to invest in and prioritize product development initiatives to align with growth ambitions.

Understanding this key differentiator allows organizations to strategically address and nurture the areas most associated with growth optimism, potentially shifting perceptions among those with no growth expectations by highlighting successes and plans in product development.

(END CHATGPT ANALYSIS)

New Learning for the DDAR Model (this section is not from ChatGPT)

The AI analysis produced an interesting overall summary that I had not discovered when reading the comments.

The last overall insight into product development was derived quickly.

Once the data was prepared and submitted to the tool, the whole analysis process took less than an hour. As my first step into using AI for analyzing data, I thought it was quite helpful and added more information to the overall growth story.

The initial focus was all about accuracy of employee intelligence as a tool to make decisions. The additional insights from the AI analysis provided a nuanced suggestion for those who do want to drive growth.

Clearly, not only are employees able to share deep insights about a topic of interest to you, but they may also contribute added information you had not considered before starting your analysis.

For me, I was interested in the accuracy of their projections about growth, but I did not expect to produce ideas for how to grow.

This bonus data point suggests that having the right data, from the right people, and analyzing that data in new ways (in this case with AI), may lead to even better, or at least new, insights for leaders’ decision making.

And if you use the DDAR model, one becomes less concerned about the absolute accuracy of the data (e.g., to grow you need new products). Instead, the path of using the data to start (vs. end) a conversation leads to new dialogues and better decision-making.

Data and dialogue produce higher accuracy and engaged team members who can help take the action needed to drive growth and results.

If you want to learn more about EI or other initiatives to drive growth and innovation, contact Dr. Theresa M. Welbourne or join the Leadership Pulse.