One of the most common questions we’re asked is, “How long do I need to keep this HR paperwork?” It’s a great question — destroying records you should be holding on to could land you in serious legal trouble. Conversely, keeping HR paperwork for too long is also not advised. This article will help you identify the proper HR paperwork retention rules.

Problem #1:

Destroying Files & Documentation Too Soon

It’s pretty obvious why employees shouldn’t simply shred or dispose of paperwork right after an issue is resolved or an event is “over.” It’s summed up well in the article Recordkeeping Policy: Record Maintenance, Retention and Destruction:

“The laws typically impose civil monetary penalties for failure to maintain statutory records. In some instances, there is individual liability and criminal liability. Proper maintenance of employment records is also critical to defending against employment-related litigation. In fact, an employer can be sued for wrongful destruction of employment records under the theory of spoliation of evidence.”

Problem #2:

Hanging On To Paperwork For Too Long

But there’s another side to HR paperwork retention: how long is too long to keep various files and documents at your office?

I really like these tips from HR Specialist about the HR documents you shouldn’t keep:

- Don’t be a “just in case” hoarder; store records only for legal, operational, or archival reasons.

- Don’t retain unscheduled temporary materials, such as drafts, reminder notes, worksheets, or extra copies.

- Don’t hang onto documents just for their sentimental or public relations value. Information must earn its keep, like any other asset. A comprehensive record of the past that fosters a “company memory” can be an asset, but be sure to minimize your legal liability while doing so.

These tips underscore the importance of getting rid of documents that could be a liability. Just as it’s important to make sure you’re keeping what you need to keep to satisfy the law, it’s important to systematically dispose of paper and electronic records that you don’t need when the time comes.

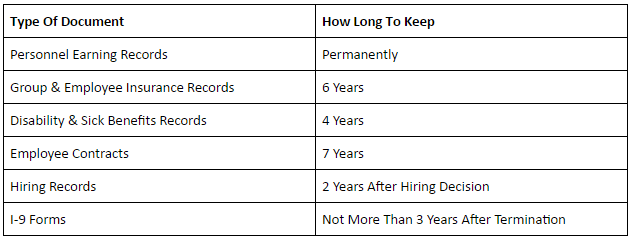

HR paperwork retention guidelines

Retention procedures vary; there are federal guidelines, state regulations, local statutes of limitations, and industry best practices your HR department needs to be aware of.

State retention statutes vary widely on tax, unemployment, and workers’ compensation records, as well as on environmental and other requirements, so check with your state and regional authorities for details.

You should also make sure you’re consulting your accounting office and attorney for the proper length of time you need to keep specific documents.

Some typical storage times

The bottom line for HR paperwork retention is to not keep extra liability on hand. Keep only what you’re legally required to keep and safely dispose of the rest.