Benefits may not be the glamorous part of human resources, but for employees, benefits rank right up there with pay in importance.

A mediocre benefits package can lose you a great candidate. Eight out of 10 employees would choose new or enhanced benefits over a pay increase.

These are only three examples of the value workers place on benefits; there are plenty more reasons why benefits — and I’m including perks here, too — are so important, in these days of 2% and 3% raises.

From a CFO’s perspective, benefits are no less significant. SHRM tells us that on average, benefits account for a third of total compensation costs. How much is that? — $8,669 per employee for health coverage alone.

From the perspective of a quality workforce, benefits may more than pay for themselves. As SHRM’s 2017 Employee Benefits research report says,

Given that two-thirds of organizations (68%) were experiencing recruiting difficulty and skills shortages for certain types of jobs in 2016, organizations need to focus on providing a competitive benefits package to retain and attract top talent.

Benefits as step-child

Yet benefits tend to be treated as a step-child by HR.

In may only be July, but open enrollment for the most fundamental of benefits – health coverage — is practically around the corner. And guess what? You’re not prepared.

Oh sure, you may already have some new numbers from your provider. Finance probably began prompting you to get going on that a month ago. But Employee Benefit Adviser says most companies are woefully unprepared for communicating with employees about the plans and the coverage.

According to EBA’s Open Enrollment Readiness Benchmark, communication planning scored a dismal 17; only preparing to enroll employees was lower, with an activity score of 16. In fact, the May benchmark report, the most recent one out, showed employers were less prepared at the end of that month than in April.

In the words of the report:

Employers with benefit start dates in the first quarter of 2018 feel less prepared for open enrollment than they did a month ago, as they struggle to nail down core procedures and routines.

Ironically, the benchmark readiness scores are self-reported by the 400 employers participating in the monthly survey. What that tells us is that even after admitting (for the April report) that they weren’t preparing very well, the HR and benefits executives not only didn’t kick it up, they actually admitted things were a little worse a month later.

What’s the rush?

A Securian Financial Group survey out this week tells us that most workers understand the most basic component of their health plan — the size of the deductible. Yet 16% don’t. That survey also discovered that an astonishing 56% of workers didn’t know many employers offered supplemental insurance.

Most large employers offer employees the option of signing up for additional coverage for accidental injury, hospital stays and other optional / supplemental coverage. But only about half the eligible employees choose at least one supplemental coverage.

That’s a statistic worth taking note of, since Securian also discovered that 8% of workers or a family member had an illness in the last five years where the out-of-pocket costs set them back financially; 4% so severely they have yet to pay all the bills.

A third of millennials paid out of pocket

It’s true that older workers are the ones most likely to suffer from a serious illness requiring hospitalization. However, a third of millennials — as a group, the ones most likely to go without coverage — had an out of pocket expense for an accidental injury.

Millennials also are your workers who are least likely to understand the arcane language of health insurance. A 2015 study of college-educated millennials “revealed poor health insurance literacy with 48% incorrectly defining deductible and 78% incorrectly defining coinsurance.”

Millennials also are your workers who are least likely to understand the arcane language of health insurance. A 2015 study of college-educated millennials “revealed poor health insurance literacy with 48% incorrectly defining deductible and 78% incorrectly defining coinsurance.”

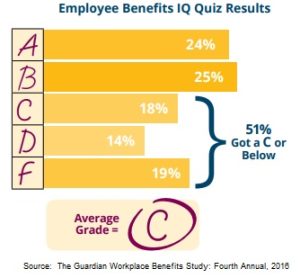

How many of your other workers know this stuff? A Guardian Insurance survey found 80% think they do, but only 49% actually do. Employers were a little more realistic; 62% of them said workers understand their benefits “very well.”

Putting this in perspective

The point of throwing all these statistics at you is to demonstrate how important benefits are to your workers. You knew that intuitively, but as the readiness scores indicate, you honor that knowledge in the breach. And most of what has been discussed here are the medical and health benefits. Other benefits and perks are important, though few, if any, have anything like an open enrollment period.

Now is the time to prepare a more inviting, interesting, educational — yes, gamified, if you are creative enough — experience for this fall’s open enrollment. You may still need the meetings, but now that you know how few of your employees — OK, not your employees, just those who were surveyed — even know you offer supplemental coverage, and that some of your employees will have a hard time covering the deductible, to say nothing of the out-of-pocket, prepare a campaign of enlightenment.

Now is the time to prepare a more inviting, interesting, educational — yes, gamified, if you are creative enough — experience for this fall’s open enrollment. You may still need the meetings, but now that you know how few of your employees — OK, not your employees, just those who were surveyed — even know you offer supplemental coverage, and that some of your employees will have a hard time covering the deductible, to say nothing of the out-of-pocket, prepare a campaign of enlightenment.

Last year Tim Sackett wrote a brilliant post offering a number of suggestions to prepare for your open enrollment. “Open Enrollment, Seriously? Yes! And Here’s What You Need to Do Now,” is as entertaining as it is informative.

Need some additional ideas? Check out “Here’s How You Can Make Open Enrollment Great This Year” and make your open enrollment Great Again!