With historic lows in unemployment rates and a growing demand for high-quality, dedicated employees, a company’s benefits and culture have never been more paramount to success. This has raised the pressure on HR professionals to strategically invest in benefits packages and services that will not just attract top talent, but also retain it. With these challenges in mind, Wellable set out to examine some of the recent and prospective trends in wellness industry investment.

Due to our experience in the corporate wellness industry, Wellable is able to gather extensive data from consultants and wellness directors at health insurance brokers across the U.S. We received 105 responses from these professionals representing thousands of companies and millions of employees. Our research specifically looked at three main areas:

The full-detailed report can be found here, but I’ve summarized the key findings from our survey.

Investment in wellness is going up

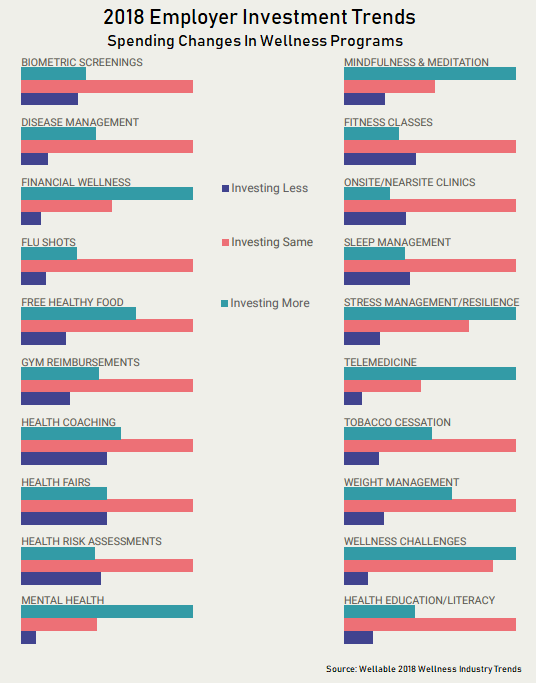

The survey identified 20 specific wellness programs and strategies, such as biometric screenings, flu shots, and telemedicine, that employers may be considering investing in this coming year. Respondents were asked whether they expect their employer clients to invest less, the same, or more in the associated program.

According to our research, 35% of wellness professionals stated that employers would increase spending on wellness programs in 2018, while only 15% reported that they would decrease spending.

Within this spending increase, most of the investment will be made in mental health, telemedicine, and financial wellness. This concentration in spending is a direct result of the rise in mental health issues in recent years, the scalability of telemedicine, and the clear need for financial education after the last major recession.

Conversely, the decreases in investment are largely in four major areas: health risk assessments, health fairs, health coaching, and fitness classes. Because each of these areas of spending is service-based, they are harder to scale, cost more per engaged employee, and are often unavailable to remote employees, which are all reasons for their decline.

On the other hand, wellness challenges (step, running, nutrition, etc.) are easily scalable and have far greater reach. They are arguably more effective at reaching those employees who need additional motivation. 93% of employers expect to invest the same or more in wellness challenge, and the demand for these solutions is strong across all employer sizes.

Decisions are based on the competition

Given the current economy and employment situation, it makes perfect sense that benefits plans have become a key tactic in fighting for top talent. When determining a benefits investment, 79% of respondents listed creating a competitive benefits plan to be the main influencer. The second most prevalent influencer was cost, at 77%, which should come as no surprise given the lack of clear ROI in the wellness space.

However, it does come as a surprise that the least influential factor reported was health care reform. Fewer than 50% of employers are expected to be significantly influenced by uncertainty about health care reform while 20% (the highest of any of the factors) expect employers to be minimally influenced. Given the turbulence in Washington, this could have major changes on requirements, prices, and other factors that would affect employer policies. It would seem that competition for quality employees is paramount in the minds of employers.

Pricing is the greatest influencer

Now that we understand what benefits employers are investing in the most and why, we need to interpret how they decide on the vendors within these domains. Pricing for vendors was the greatest influence, which can be the result of quite a few factors. First and foremost, wellness benefits are still relatively new in the grand scheme of corporate America. Naturally, this means that many of the key decision-makers when it comes to budgeting may not be sold on the efficacy of various programs and the influence they have on attracting/retaining top employees.

Secondly, also relating to the youth of the industry, wellness brands have not yet been around long enough to truly differentiate themselves from competitors in the minds of buyers. Along these same lines, customer testimonials and domain expertise have shockingly little influence on vendor choice. For those with an appreciation and understanding of how wellness programs affect employees, it can be somewhat disappointing to see these survey results. However, it is anticipated that, as employers gain more experience with the various program options, we will see a shift in this balance.