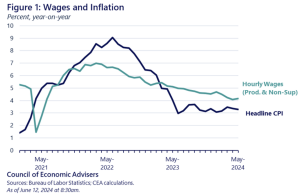

In the year to April 2024, many employees could be excused for thinking things were brightening up when it came to wages.

The first bit of comfort was that average employee pay grew by a very healthy 4.7%, compared to an inflation rate of 3.4%. Result: real extra money in people’s pockets.

In fact, wage growth so far for 2024 is above average in 47% of job sectors (compared with 2019).

But this is where the good news is likely to end.

Because after a good year of above average pay growth, all the signs are that wage growth will stabilize, or even stay still – which might lead some CHROs questioning how to decide their pay strategy going forward.

One of the most keenly-asked question is whether they should continue, for example, to out-pay the rest of market to guarantee attraction and retention, or whether they steady their pay ship, by relying on minimal increases, hoping staff will prefer to have a job rather than quit for pastures new?

The question isn’t an easy one to answer, but aiming to answer this, and several other questions in his new book, Get Pay Right: How to Achieve Pay Equity That Works, is Kent Plunkett, CEO of Salary.com.

Plunkett founded Salary.com with the simply idea that every employee should be able to find out what they’re worth and use that info to negotiate their pay. To this extent, he’s probably not every HR practitioner’s friend!

However, in the years since, he’s been providing HR professionals and business managers with a toolkit they can use to set better pay, and also achieve pay equity.

Plunkett argues that embracing pay equity not only fosters an inclusive workplace culture but also boosts engagement, performance, and ROI, crucial for businesses eyeing global competitiveness.

But with 77% of employees not knowing how people are paid in their organizations, and only 42% of companies involving a chief diversity officer in talent acquisition decisions, how do CHROs think about their pay, and think about it in a way that helps get to this desired place?

Well, in a TLNT exclusive we have an exclusive peak at his new book – an excerpt around why all organizations need a proper compensation strategy if they are to achieve pay equity (and what questions they need to ask to achieve it):

If you want to read more, click to order his book here.

Why all organizations need a compensation strategy

It’s much better to be able to plan for raises and handle budgeting for benefits when you know your strategy for compensation in general, know what’s going on in the market, and have thought through your approach to staying competitive.

But pay equity is an essential piece of your compensation strategy too. This is where the commitment to diversity, equity, and inclusion (DEI) and pay equity become real – by committing to and budgeting to close pay gaps.

Companies need to ask themselves whether they have a coherent set of values and criteria to explain why people make the compensation they make.

So, as new people are hired (and at higher rates), it’s essential to track what’s happening overall with pay equity and whether any pay gaps can be justified for legitimate business reasons or whether there is potential bias that can be correlated to gender, race, age, or other protected factors.

Most pay equity issues are not intentional and can be difficult to spot.

If it’s complicated or messy, that’s absolutely normal. But it’s worth the time and effort to step back and review the organization’s approach to compensation and articulate what you’re trying to do with pay and assess if it’s working.

Monitoring pay equity will help you implement your compensation strategy and address any issues before they become bigger problems.

Here are the things to think through when you are building a compensation strategy.

What Is your compensation philosophy?

Start with your compensation philosophy. Identify the principles and practices your organization uses to make compensation decisions:

- Do you generally make offers at the midpoint of the market rate for that role, or is it usually higher or lower? Why?

- What are the important considerations for how you determine incentive pay, and how do you allocate incentive and base pay?

- What consideration do you give benefits, leave, bonuses, and perks when you make decisions on wages?

The focus should be on why you pay people what you pay and what factors are important in how your total compensation is structured.

Is your compensation philosophy working?

You can always do more of what you’ve been doing. But before you make that the default, it’s worth understanding whether it’s working.

Before you start making compensation decisions, it’s good to get a clearer picture of some key indicators:

- Track your turnover by role. Are you seeing higher than normal attrition?

- Look at average tenure by role. Is it trending longer or shorter? Do you know why?

- Are there gender pay gaps or other pay equity issues? When was your last pay equity audit?

- What’s happening with employee engagement? Look deeper than the overall scores. Engagement data by department or demographic can reveal insights on where there are issues. If you find potential issues, evaluate what role, if any, compensation is playing in employee satisfaction and turnover

Are you monitoring compliance?

There are some aspects of compensation that are required by law and not optional. Understanding and monitoring compliance with compensation laws should be an essential part of any compensation strategy:

- Have you met minimum wage, overtime, and payment requirements under local, state, and federal law for every location you have employees?

- Have you assessed pay equity and established a process to analyze and

address any pay gaps? - Are you up to date on new laws and changes regarding sick leave, parental leave, and other paid leave; pay transparency requirements; and other laws affecting compensation and payroll including laws on privacy and the transfer of data about employees?

Does your compensation align with business strategy?

This is where you look at where the organization wants to go and what resources are allocated to getting there:

- What are the measurable goals for the company?

- Do you have the people you need to get the work done?

- Is there budget available to make sure you can hire and retain the people you need for the work? If not, identify gaps and what it takes to close them. If there is a significant mismatch between goals and compensation budget, then you need to adjust one or the other or both.

Does your compensation align with the market?

Assessing how your pay compares with similar organizations will tell you if your compensation budget is realistic and competitive:

- Are your current salary ranges competitive for your location and industry?

- In a rapidly shifting environment, are you prepared to make adjustments?

- How do proposed changes affect pay equity?

If your compensation is not competitive, you will need to figure out how to adjust budget or headcount and get creative with benefits and other aspects of total compensation.

How does employee performance fit into your compensation strategy?

There is a bit of a myth that if employees meet goals and perform at or above expectations, they should get a raise each year.

That’s not always possible and often not how it works. There are many types of incentive pay designed to encourage certain performance besides annual raises or cost-of- living adjustments:

- Can you create bonuses tied to performance or meeting specific goals?

- Is your sales commission program effective?

- Do you have the right mix of base pay and incentive pay?

- Do you use vesting of stock options or other benefits to encourage retention?

How does total compensation fit into your strategy?

Money is not always the most important thing to people.

Scheduling, the ability to work remotely, paid time off, signing bonuses, and help with retirement savings or student loan payments can all change the equation for potential and existing employees:

- Do you know what matters most to your employees?

- What benefits are used the most?

- What else could you offer that might make a difference to people you

want to recruit or retain?

While money is always an important factor, there are many other aspects of total compensation that can make your organization stand out against the competition. Know what they are and regularly reevaluate what’s possible.

Building a successful compensation strategy is about having the right information on your organization, the market, and the organization’s goals, then determining what’s working, determining what isn’t, and exploring options.

Remember, labor costs are the biggest line item of most organizations’ budget. Having the right people doing the work is what makes a business successful. Therefore, getting pay right is essential to operations, no matter what your industry or company size. Having a clear compensation strategy will also help you recruit and retain employees and make budget and planning easier and more straightforward.