In the latest “Compensation Best Practices Report,” which gathered responses from 7,100 respondents on their pay practices, PayScale – the company where I work – took a look at what really sets top performers apart.

In this report, top-performing organizations were defined as those who are number one in their industry and which also met or exceeded their revenue goals in 2017.

What PayScale found is that compared to typical organizations, top-performing organizations often make different decisions about compensation, culture and pay brand. We identified four sets of behaviors that set top performers apart:

- They consider pay to be an ongoing practice, not an annual event.

- They build their pay brand with intention.

- They trust their managers and train them to talk about comp with employees.

- They listen to their employees.

Pay as an ongoing practice

Top-performing organizations tend to consider pay to be an ongoing dialogue with employees, not an annual event that comes and goes. In the survey, top-performing organizations reported doing these things more frequently:

- Complete a market study: 56% of top-performing organizations have completed a market study within the past year vs. 51% of typical organizations.

- Give bonuses: 31% of top-performing organizations give bonuses or incentives at least quarterly vs. 28% of typical organizations.

- Check market data for individual jobs: 37% of top-performing organizations get market data for individual jobs at least monthly vs. 33% of typical organizations.

Build pay brand with intention

Top-performing organizations are also more likely to connect the dots between compensation and culture. They recognize that the way they pay, including how much and why, matters to their potential employees and current employees.

They start by being intentional about how they spend their compensation budgets: top-performing companies are more likely to have a formal compensation strategy (46% vs. 35% of typical). In practice, this means they:

- Reference market data for their jobs. Only 18% of top-performing organizations do not complete full market studies (vs. 24% of typical). They are also more likely to let that data drive their pay higher for competitive jobs (58% vs. 50% of typical).

- Give base pay increases. 87% of top-performing organizations gave increases in 2017 (vs. 78% of typical). They also budgeted higher increases: 33% of top-performing organizations budgeted higher than 3% raises (vs. 27% of typical).

- Use variable pay more often. 79% of top-performing organizations use variable pay vs. 70% of typical organizations. When they do, they’re also more likely to budget their variable pay (only 18% of top-performing organizations don’t budget variable pay vs. 27% of typical).

- Fight to keep their talent. Only 28% of top-performing organizations don’t counteroffer if an incumbent gets an offer, vs. 32% of typical, especially if the employees are high-performers (25% of top-performing organizations vs. 19% of typical). But see “Counter-Offers: Why They Don’t Deliver Much Bang For Your Buck.”

- Top-performing organizations are actively addressing pay inequities due to gender (25% vs. 17% of typical) or ethnicity (18% vs. 15% of typical).

- Have greater aspirations for being transparent with their pay practices. 62% of top-performing organizations aim to be transparent about pay in 2018 (vs. 56% of typical).

Trust and train managers to talk pay

Top-performing organizations are more likely to trust their managers to have difficult pay conversations with employees.

In fact, 67% of top-performing organizations are either confident or very confident in their managers’ abilities to have tough conversations about pay (vs. 57% of typical). They are also more likely to train managers to talk about pay (36% vs. 27% of typical).

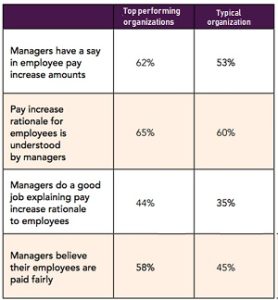

Finally, top-performers are more likely to report that their managers have a say on pay for their direct reports, understand the pay increases approved for their direct reports, can explain the rationale behind increases and believe their direct reports are paid fairly. In short, they give their managers credit for knowing both how comp decisions are made and how to communicate comp across their organization.

For more on manager involvement in pay decisions, see “What If Managers Didn’t Make Comp Decisions?”

Listen to employees

Top-performing organizations get a pulse on employee engagement much more frequently. 24% use ongoing or real-time surveys to measure employee engagement, vs. 16% of typical organizations. What’s more, they actually pay attention to results: 32% of top-performing companies have changed their pay strategy as a result of employee feedback (vs. 26% of typical).

Find out why your compensation strategy has the power to make or break your business this year. Download the full Compensation Best Practices Report here.