While it’s fair to say there are several (positive) signs of economic strength right now – everything from low unemployment to solid job growth – this hasn’t dampened the fact there is still widespread pessimism about the state of the economy.

According to a recent Gallup survey, just 27% of Americans rate the economy as excellent or good, while 45% rate it as poor. Americans aren’t optimistic about the future, either –with 63% believe economic conditions are worsening.

TikTok users have even coined a new term to describe the disconnect between what appears to be a healthy economy on paper and how they feel about their finances – the so-called “silent depression.”

Inflation remains one of the top reasons for this dismal economic assessment. Despite it falling American workers are still concerned about shrinking savings and the stickiness of high prices.

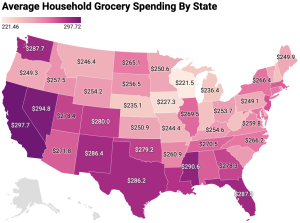

A recent Harvard study found that a record 22.4 million American households spend more than 30% of their income on rent and utilities. The cost of daily essentials like groceries remains high [Americans now spend an average of $1,080 per month at the grocery store], while debt levels continue to rise.

Source: Daily Mail

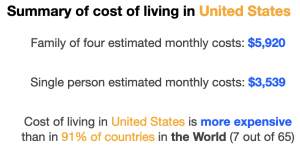

Source: expatistan.com

Beyond all this, interest rates have been at their highest level in decades, and the Fed is still too concerned about inflation to begin lowering them. This means getting a mortgage and buying a home – the cornerstone of the American dream – is now beyond many people.

Over the past decade, the median home price in the United States has surged from $275,000 to $417,000. While the average 30-year fixed mortgage rate was around 3% in March 2021, it’s now 6.9%. Buying a car, or starting a business is also more expensive.

The need to help employees have financial stability

Given all the above, it isn’t difficult to see why so many Americans feel like their circumstances aren’t reflected in the headlines about a strong economy.

But as employees become increasingly worried about their economic prospects [personal savings levels are all down], it only seems logical that HR teams need to focus on helping employees work toward financial stability.

This means offering financial guidance and other wellness initiatives, providing more robust benefits, and making the financial health of the workforce a top priority.

Employee demand for financial assistance is on the rise

When employees are stressed about their finances, this can lead to lower engagement and productivity in the workplace.

A recent SoFi survey found that financial stress harms employees’ focus, motivation, sleep, mental health, and other well-being indicators.

It’s no wonder that nearly three-quarters of employees say they want help with their personal finances.

But are HR teams actually providing this help?

The evidence suggests that they are not.

Have a look at some some recent statistics:

While 96% of employers say they feel responsible for their employees’ financial health, just two-fifths offer financial wellness programs.

And yet there’s the thing. Employees say these programs would positively impact their job satisfaction and engagement, productivity, physical health, and ability to reach financial goals.

As PwC reports, financially stressed employees are twice as likely to look for a new job, while 73% “say they would be attracted to another employer that cares more about their financial well-being.”

HR teams need to meet employees’ financial needs

While more than three-quarters of HR teams believe employees’ financial well-being is good or excellent, just 59% of employees agree.

Employers need to get with it, because employees expect more financial assistance from their companies, particularly as economic pressures continue to mount.

They’re telling companies that a greater emphasis on their financial health will have a wide range of positive effects: higher performance levels, engagement, and retention.

HR teams should be responsible for giving employees the support they need to ensure their long-term financial security – as well as the health of the company.

So what can CHROs do?

Employees are increasingly taking advantage of their companies’ financial services and asking for greater assistance.

Beyond financial guidance, employees also want direct financial benefits such as increased 401(k) matching and on-demand pay.

According to a recent Bank of America survey, one of the top factors that lead employees to stay with their current companies is the availability of competitive benefits.

However, too many companies fail to provide benefits that improve employees’ finances.

One way to address this issue is by repurposing existing benefits in ways that address employees’ financial needs.

For example, Pew reports that most employees don’t use all the PTO offered. With convertible PTO, employees can redirect the value of their unused time off toward financial priorities such as student loan payments and retirement contributions.

PTO Exchange research has found that 90% of employees would be more inclined to stay with a company that offers flexible benefits like convertible PTO.

These benefits are especially important as workforces become more diverse.

PTO Exchange found that employees use convertible PTO differently depending on gender, race, age, and socioeconomic bracket.

Unsurprisingly, Bank of America recommends “specialized” benefits to account for employees’ unique circumstances and financial goals.

While employees are contending with difficult economic conditions, HR teams can step up to help them achieve financial stability.

This will reduce stress, contribute to overall employee well-being, and make the workforce far more productive and loyal.