In today’s tight labor market, it is more important than ever for organizations to continuously refine their employer value proposition and reiterate what makes them different from the rest. In order to attract and retain talent in the new world of work, employers need to take a fresh, hard look at what employees really want and adapt.

In a climate of constant change, what employees often want most is flexibility. Workers are increasingly interested in achieving flexibility not only in the obvious ways, such as by working remotely, but in additional ways that employers have not yet fully considered — like the ability to choose when they get paid.

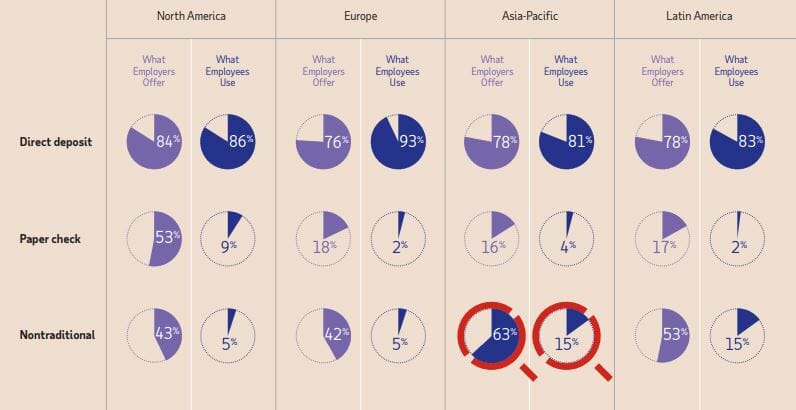

Knowing compensation would play a role in the changing world of work, we recently released the results of our global Evolution of Pay study. The study, which explores employee and employer perceptions and attitudes about traditional and emerging pay methods, found a demand for more flexibility among employees with regard to how and when they get paid. That makes sense, as alternative work arrangements and gig work are on the rise, and traditional weekly and bi-weekly payroll cycles are too rigid to meet the needs of the agile workforce. Furthermore, expectations around the payment experience and how currency changes hands have changed, in general, given the explosion of user-friendly digital payment tools in the market over the last decade — from PayPal to Square and Venmo.

Employees and employers overwhelmingly agree there is a general need for more choice in pay. In fact, 78% of employers surveyed by ADP Research Institute agree that companies will need to customize payment options to remain competitive in the war for talent. Confirming that view, 62% of employees say pay options, such as the ability to choose pay frequency, would make a difference when considering a job offer. 29% of employees say the ability to have early access to earned wages would make a difference when considering an offer while 26% say the ability to receive same day pay would make a difference.

The data shows that people are interested in a personalized pay cycle that meets their needs, not the other way around.

Employees also want to work for organizations that take an active interest in their financial wellness. According to the survey, 79% of employees say they want to work for an employer that cares about their financial wellness, while 90% of millennial employees are willing to share at least some personal information, such as spending habits, bank balances and family/healthcare needs, with their payroll provider to track finances and receive advice.

It is no surprise that proactively looking after their own financial wellness has become a top priority for workers in an era of career instability and self-managed gig work; nor is it surprising that mega-sharing millennials are willing to do the same for the purposes of receiving financial wellness support. When it comes to managing their financial wellness, the data shows this group is looking to employers for money management tools and support.

One of our goals with this study was to assess the changing payment landscape and the role of pay in talent management. What we found is that there is, indeed, a connection between pay and attracting and retaining talent in today’s workforce; employees are looking for pay choice and employers are looking at pay-as-a-perk.

While on-demand, real-time pay can help employers more smoothly navigate constant change in the workplace, the ability to choose when and how they get paid can help employees better navigate and manage change in their own lives, as well.