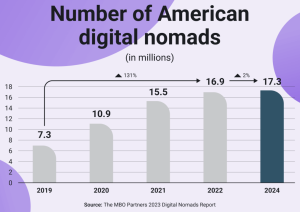

As the workforce continues to race toward remote work, digital nomads – office-less, remote workers – are increasingly common.

Latest figures suggest there are there are more than 40 million digital nomads worldwide in 2024, and 17.3 million of these are in US alone (whose numbers were up 2% in 2023 compared to 2022).

Source: https://pumble.com

The result of this, however, is that countries are pouncing on this growing trend and providing a relatively new visa option: the digital nomad visa.

Digital nomad visas – a potential problem brewing

A digital nomad visa qualifies an employee to work in a country for an extended period.

However, these digital nomad visas have the potential to confuse employees, HR managers, and corporate leaders because they typically won’t shield employees from tax requirements and corporations from withholding obligations.

If employees and corporate leaders don’t pay attention to the tax and compliance obligations digital nomad visas may pose, they could violate tax laws, be hit with fines, and experience significant compliance issues in the future.

What is a digital nomad visa?

Let’s start at the beginning.

Digital nomad visas are special visas designed for people who plan to work remotely from a country where they don’t have citizenship or as another avenue to work visa-free.

These visas generally fall somewhere between a tourist visa and a business visa, allowing remote employees to work for an extended period within a country.

Digital nomads and digital nomad visas are growing rapidly in popularity.

According to Statista, as of 2022, there were already more than 15 million digital nomads within the United States alone.

We’ve already seen these numbers increase, and a separate Statista report found the percentage of employees who work remotely all or most of the time, as of 2023, hit 28% worldwide.

That’s nearly triple the share of remote workers from 2019.

Who issues digital nomad visas?

In response to the boom in mobile work, countries across the globe have adopted digital nomad visas.

Although these figures are constantly shifting, the latest report by the UN World Tourism Organization counts 54 destinations that now offer digital nomad visas.

The dangers of digital nomad visas

Although digital nomad visas cover an employee’s immigration status, they don’t address tax implications.

This can expose both the company and the employee to risks if either overlooks their tax or reporting responsibilities.

Here are a few risks that digital nomads, HR managers, and corporate employers need to consider when mobile employees work from abroad:

- Withholding obligations

Several countries require companies to withhold a portion of employees’ monthly paychecks, even when they’re working as digital nomads. If the payroll department isn’t on the same page as employees, they could risk misreporting taxes or owing foreign governments unmet withholdings.

- Lost or changing compensation

If an employee ends up owing more tax within a country than they expect, they may feel as though they need increased compensation to make up the difference. That puts HR and corporate leaders under extra pressure to commit to raises.

- An unwanted corporate tax presence

If employees work within some countries for as little as a few months, they could inadvertently create a corporate tax presence in that jurisdiction. In turn, the company may end up owing corporate taxes in that foreign country.

- Double taxation: Employees who receive a digital nomad visa sometimes think they’ll be exempt from taxes in either their home country or the country they’re working from. This isn’t always the case. For instance, sometimes an employee isn’t able to avoid US federal withholdings by simply working in a foreign country. In other cases, the employee may need to apply for a foreign tax credit to recover withholdings. That all increases the risk of double taxation—and frustrated employees.

How to protect employees against digital nomad visa tax risks

If you’re a digital nomad, there are a few ways you can help reduce the risk of misreporting, being double taxed, or breaking tax rules.

1. Get familiar with your work and home country’s tax rules

It’s essential employers research the tax rules in that country, including income and/or social taxes. Pay attention to whether or not there are tax breaks available, and don’t assume workers will be automatically be exempt from taxes in every location they travel to for work.

Make sure you also understand how a home country’s tax reporting is impacted by people working abroad. For example, tax filings for Home national and sub-national (e.g., state, provincial) tax purposes may still be required even if workers are working in foreign countries.

2. Get approval from your company before you travel

Employers must approve any workers’ application to work abroard to ensure the payroll department is on the same page. This can help you avoid scrambling to gather tax credits late in the year. Payroll needs to be able to withhold the correct amount from peope’s paycheck and funnel it to the correct entity.

How HR and corporate leaders can avoid tax problems

Here are a few tips to help HR and corporate leaders protect the company from mobile tax and legal setbacks:

1. Update your work travel policies

Identify the tax rules for the countries your employees plan to work from and set up clear policies that determine where employees can and can’t work. These updated policies should explain how long employees can work from a given location and map out the approval process they need to go through before applying for a digital nomad visa.

2. Provide tax resources for your mobile employees

Taxes can become extremely complicated when employees work from different countries. To avoid overwhelming employees, double taxation, and lost benefits, it’s wise to give employees access to tax experts who understand the laws and tax obligations within the countries where they are allowed to work.

3. Make sure employees remain qualified to work under your country’s labor laws

It’s important to understand the local laws of the countries your employee is working from and take action to ensure your employee remains subject to the labor laws of your corporation’s local country. Otherwise, your employee may end up jeopardizing your vacation laws, 401(k) contributions, and other benefits.

The bottom line?

Mobile work isn’t going anywhere, and as more and more employees work from abroad, acquiring a digital nomad visa could provide a false sense of security.

To avoid tax violations and significant corporate tax burdens, both employees and company leaders need to adopt a more proactive stance toward mobile taxes.

By improving travel policies, communicating risks, giving employees resources, and taking action now, corporations can protect against tax disasters that could arise out of remote work.