In a very public resignation published Wednesday morning in The New York Times, former Goldman Sachs executive director Greg Smith blasted the investment firm for a culture that is “toxic and destructive.”

“It makes me ill how callously people talk about ripping clients off,” said Smith, who headed the firm’s United States equity derivatives business in Europe, the Middle East and Africa until today.

The response to his opinion piece was both fast and substantial. From Forbes‘ call for the resignation of Goldman Sachs CEO Lloyd C. Blankfein, to the multiple posts on The Huffington Post, and even a humorous parody in the United Kingdom’s Daily Mash, Smith’s resignation and comments set off a firestorm.

For its part, Goldman Sachs issued an almost perfunctory statement: “We disagree with the views expressed, which we don’t think reflect the way we run our business. In our view, we will only be successful if our clients are successful. This fundamental truth lies at the heart of how we conduct ourselves.”

Two key issues for HR

Hardly anyone outside of Goldman Sachs — and perhaps Wall Street generally — will give much credence to the company’s statement. Even a quick read of the Forbes‘ post offers plenty of evidence that what Smith wrote is resonating with the business community, not to mention with the broader public, which has been well primed to believe the worst about the financial industry.

Out of all this, however, come two key issues for HR professionals.

The first, obviously, is the impact Smith’s resignation post will have on recruiting. The Goldman Sachs brand was already tarnished by the industry’s collapse at the beginning of the Great Recession. The $550 million SEC fine the firm paid for its marketing of subprime mortgages didn’t help.

But it isn’t just Goldman Sachs that has a problem. The entire industry will be affected by the fallout.

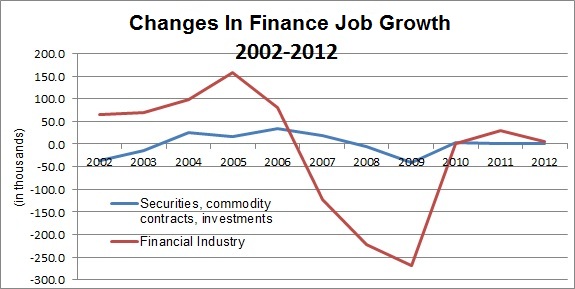

Financial industry jobs as a whole went negative in 2007 and have barely recovered. In the securities and brokerage business, there’s been no job growth in two years. At its peak in August 2008 the sector had 872,900 jobs. Last month, according to the Bureau of Labor Statistics, it had 801,800 jobs.

Financial industry jobs as a whole went negative in 2007 and have barely recovered. In the securities and brokerage business, there’s been no job growth in two years. At its peak in August 2008 the sector had 872,900 jobs. Last month, according to the Bureau of Labor Statistics, it had 801,800 jobs.

The lack of growth, coupled with the industry’s black eye and the Occupy movement, which kept the issue in the forefront all winter, already made for a challenging recruiting environment.

Now Smith’s resignation adds yet another dimension, especially with the best and the brightest of America’s college students. It’s hard to believe they won’t have second thoughts about interning at the firm after reading his lament about his management of the program: “I knew it was time to leave when I realized I could no longer look students in the eye and tell them what a great place this was to work.”

Does public bridge-burning ever make sense?

The other issue raised by Smith’s public resignation is the more familiar one of burning bridges. Smith is “toast” as far as Wall Street is concerned, says Blooomberg columnist William Cohan, author of “Money and Power: How Goldman Sachs Came to Rule the World.” “He is in the witness protection program now,” Cohan quipped in in an interview about the issue.

Reuters business writer and respected finance blogger Felix Salmon raises some of the obvious questions, pointing out, “if the people who work for (Smith) are constantly asking how good a deal is for Goldman, rather than how good the deal is for Goldman’s clients, then that’s because of the example he set. What’s missing in his op-ed is any sense of mea culpa, any sense that he was at all part of the problem.”

Even the left-leaning Mother Jones questioned Smith’s motives in going public.

“So it’s a little hard to know what to make of this. Is Greg Smith a disgruntled employee? A genuinely outraged man of honor?,” asks Mother Jones blogger Kevin Drum.

The Ladders puts this into the perfectly stark terms of a job leaving, job seeker. Says an email pitching an article about the Smith resignation, “Marc Cenedella, CEO & Co-founder of TheLadders… suggests that after writing an angry letter like this, the employee must follow these important three steps:

- Put the letter in a drawer

- Go on vacation for a week to relax, recuperate, and refocus

- Burn the letter upon return.

A larger public service?

It’s good advice for most of us, and the kind of counsel any wise HR professional would give a departing employee. But I have to believe there are times when a larger service is performed by going public in the way Greg Smith did.

Whatever his motives, regardless of their purity, and ignoring the dissonance of denouncing an institution and a culture in which he indulged and profited, the public discussion Smith fanned is good for the country. Goldman Sachs is not some local bank, but a global power; one that can move markets, and influence national economies.

It’s certainly a tricky situation for every career counselor and HR professional who has ever dealt with a disgruntled employee. Doing what Smith did is not something that most employees for most employers will ever do, or, if they do, that anyone will much care about.

But for people like Smith at institutions like Goldman Sachs, should we be counseling them to not speak out?