It’s a well-known fact that the US workforce is one of the most over-worked in the world – toiling for an average of 1,791 hours per year (compared to the OECD country average of 1,716).

Compared to German workers, the average American puts in an extra 442 hours a year (that’s another 55 days!), and 294 more than the average UK worker.

Working later in life too

With such a long working-hours culture, one might expect Americans to at least retire at a sensible age.

Yet the fact of the matter is, that here too workers are working increasingly longer stints.

According to a recent briefing from the American Enterprise Institute (AEI), the average age of retirement has increased from 62 to 65 years over the past thirty years.

Further data suggests adults aged 65 and older are now twice as likely to be working today compared to 1985.

All-told, The Bureau of Labor Statistics estimates that 13 million Americans age 65 and older will be in the labor force by 2024.

LABOR FORCE PARTICIPATION – 2000 – 2030

(US Bureau of Labor Statistics)

Benefits versus drawbacks

On first appearances, this may not sound like such a bad thing.

Employers continually lament a lack of ‘work-ready’ people – people with the sorts of skills and resilience that older workers tend to exhibit.

And, let’s fact it, life-expectancy during the last 30 years has increased by much more than the extra three years people are working – so it could be seen as sensible not to retire so early if one still has plenty of life to live left.

But, this is not to say there are some concerning trends here too.

In 2019, 20% of adults over the age of 65 were either working or looking for work (the last time this happened was in 1962).

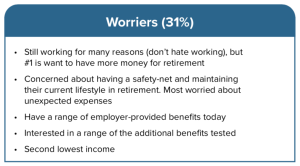

And the sad fact is, they’re not necessarily working because they ‘want’ to – but more that they can’t afford not to.

For instance, nearly half of all Americans have no retirement savings. Around 15 million adults aged 65 and older are also described as being ‘economically insecure’ – that is with incomes below 200% of the federal poverty line.

Nearly 9 million Americans over 50 still have student debt, and even though the pandemic saw a raft of US workers retiring early, the rising cost of living is now causing a wave of ‘unretirements’. In October 2021, the unretirement rate was 2.6% – that is people reported as being retired now back in work 12 months later.

Why all of this matters

These numbers matter, because whilst employers might initially rejoice about re-gaining much needed skills, it’s highly likely companies are filling up with ‘returning because I have to’ staff.

These are people who exhibit poor engagement levels, and are simply turning up, but not really getting involved.

Do employers really want a growing cohort of people who really don’t want to be there, but are just there for the dollars?

As many as nine in ten older workers don’t really want to be there

Fresh data adds more worry to this question.

According to a just published study by Voya Cares and Easterseals, a staggering 92% of what it calls ‘employment extenders’ indicate that they are only working into their later years because they ‘need to’, or ‘want more money for retirement’.

Overall, it finds most ‘employment extenders’ say they have not saved

enough for retirement, with only 22% of those polled saying they were confident they would have enough money to live on for when they do eventually retire.

“These people may be telling themselves they are making a choice to work longer,” it says. “But, in fact, many are doing so out of necessity.

The four types of employment extender

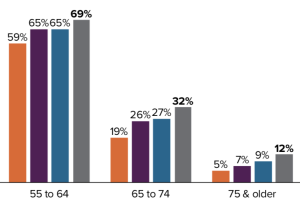

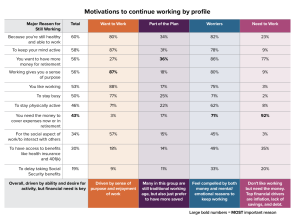

On interrogating this further, the research identified four distinct groups of older workers:

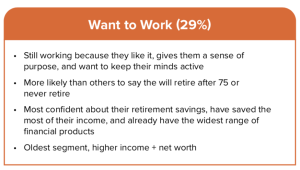

- Those that “Want to Work”

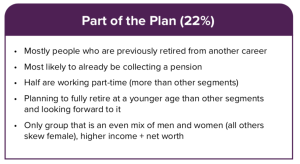

- Those for whom working longer is “Part of the Plan”

- Those who still have to work because they are “Worriers”

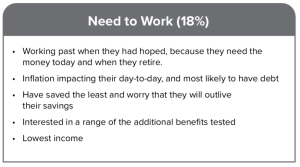

- Those who simply “Need to Work” to put food on their plates, and a roof above their heads.

Those that ‘want to work’ comprise around 29% of employment extenders, while those for whom working is ‘part of the plan’ comprise around 22%. These sound like an employers’ dream.

However, this means that nearly half (49%) of all older workers (worries – 31%; need to work 18%), would still rather not be there at all.

Employment extender profiles:

Managing the ‘I need to work’ cohort must be a top priority

Speaking exclusively to TLNT, Jessica Tuman, VP of Voya Cares says: “People are telling us that they either haven’t saved enough during their working life up till now, or have caring commitments that require them to carry on earning, or that the lack of health cover is also driving them to carry on working longer – or all three!”

She adds: “A quarter of respondents said they were having to plan their finances around having care giving in some shape or form. As such, we’re now seeing people of working age into their 80s.”

Cynic could well argue that employers are benefiting from their employees’ lack of financial planning, but if these people don’t really want to be there, they also need to accept they could have a problem on their hands.

Says Tuman: “I don’t think employers are exploiting employees’ need to work, but if employees feel like they ‘have’ to work, then employers could do a lot more to make that work more engaging for them – for instance using the vast experience they have to offer by creating training or mentoring roles, or be given more support more relative to their age – such as reduced hours/working weeks if they want it.”

The key – she says – is for HRDs to make later-age working a win-win for both parties involved, not just the employer.

Says Tuman: “We’ve got to remember that work keeps people vibrant, young, healthy, and for many gives them a structure, and a purpose and a sense that they are contributing to society. So this ‘usefulness’ element of working needs to be brought to the fore.”

She adds: “At the same time, employers need to be working much harder to have conversations about transitioning people appropriately into retirement, and helping them understand what they income needs are. The whole reason we’ve seen unretirements is become there is something of a shock value when people that have retired see how quickly their savings go down.”

In the meantime, Truman says firms should both enjoy, and support these older workers while they are with them.

“Older workers are a massively valuable asset that shouldn’t be ignored,” she says. “Firms will miss them when they do eventually retire, so they should do all they can to make their final working years the best they can be.”

Graphical data sources: Voya Cares and Easterseals